New Jersey Consumer Fraud Act Defenses

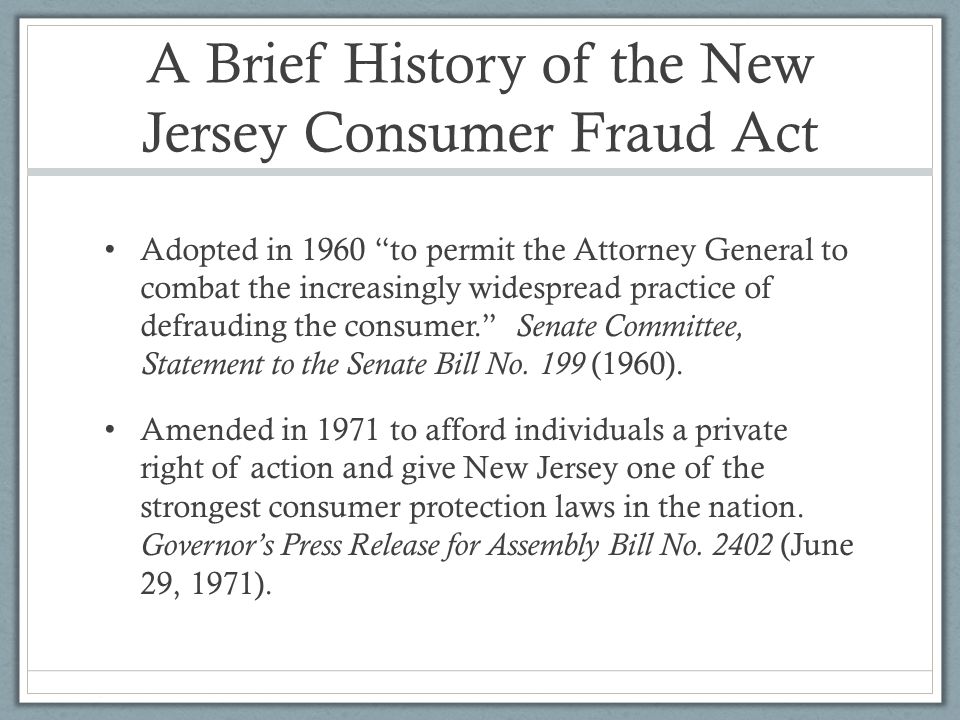

The act was amended in 1971 to add additional protections for consumers within the state. The new jersey legislature has passed the new jersey consumer fraud act.

2

Troutman sanders regularly represents clients across a broad spectrum of industries, including financial services, in the defense of new jersey consumer fraud act claims in state and federal courts, at both trial and appellate levels.

New jersey consumer fraud act defenses. On september 12, 2013, in perez v professionally green, llc, (215 n.j. To maintain a claim under the consumer fraud act, a private litigant must establish “ (1) unlawful conduct by the defendants, (2) an ascertainable loss on the part of the plaintiff, and (3) a causal relationship between the defendant’s unlawful conduct and the plaintiff’s ascertainable loss.”. The new jersey supreme court announced a sweeping expansion of the nj consumer fraud act, n.j.s.a.

The division of consumer affairs shall not be liable for any civil damages as a result of any acts or omissions undertaken in good faith in the creation, maintenance or updating of the list of children's products in accordance with subsection a. The new jersey consumer fraud act defines consumer fraud as “any unconscionable commercial practice, deception, fraud, false pretense, false promise or misrepresentation” in connection with the sale of goods, services or real estate. The consumer fraud act prohibits merchants, sales people and contractors from.

Defending your company against alleged violations of the new jersey consumer fraud act. And (3) a causal relationship between the unlawful conduct and. The consumer fraud act (“cfa”) was created to fight deceptive practices in the sale of services, goods, and real estate.

It is intended to protect consumers in this state from deceptive commercial and business practices. Defense of consumer fraud act claims. The new jersey consumer fraud act (cfa) was signed into law in 1960 and provides some of the strongest consumer protections available anywhere in the united states.

In response to the foreclosure suit, the borrower raised a defense under the new jersey consumer fraud act alleging that freedom mortgage’s procurement of the refinance loan constituted an unconscionable commercial practice such that the loan was created under false pretenses and constituted fraud. Plaintiffs appealed and won reversal. Notwithstanding the same, on thursday, november 18, 2004, the appellate division found that a consumer may only be awarded attorney fees if he can demonstrate an ascertainable loss caused by the violation of the consumer fraud act.

The consumer fraud act broadly defines “person.” it includes both natural persons and business entities such as corporations, llcs and partnerships. It is not disputed that the new jersey consumer fraud act applies to realtors. (1) a violation of act, and (2) an out.

Damages are calculated in monetary loss only and assigned a 3x punitive award. 388), the new jersey supreme court made a major change to the new jersey consumer fraud act, n.j.s.a. Additionally, we can use the discovery process to show that the owner did not suffer any “actual” and “ascertainable” loss, which is required for recovery of damages under the new jersey consumer fraud act.

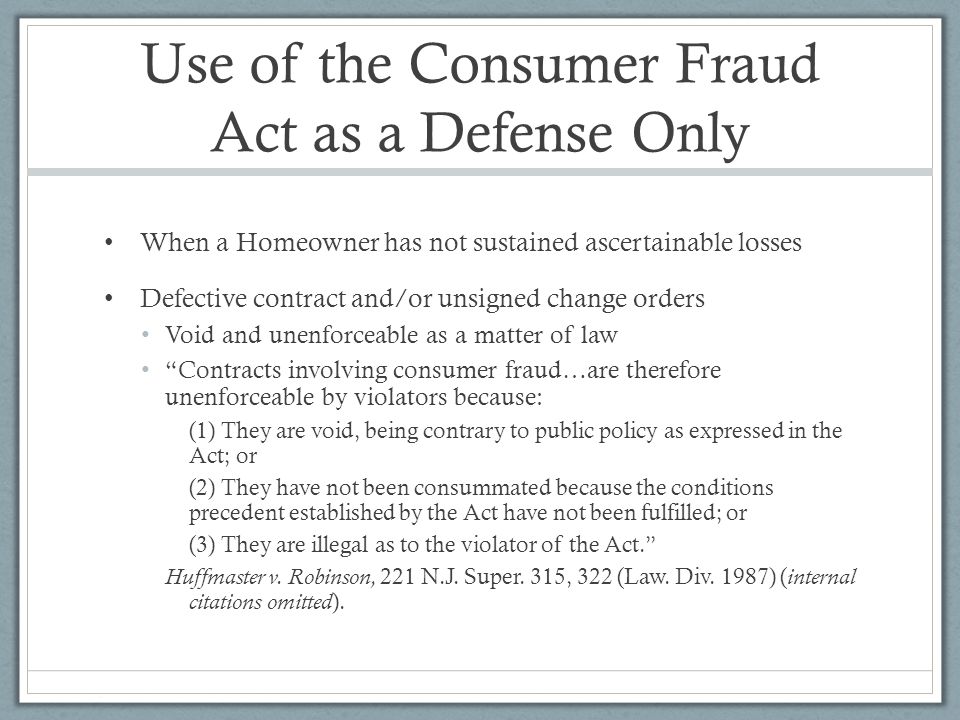

The best defense to a technical violation of the regulations is to ensure that the contract itself has no violations, and the best way to do this, of course, is to have a contract. New jersey has one of the most liberal consumer protection statutes in the nation, the new jersey consumer fraud act. To establish liability under the act, proof of three elements is generally required:

Defendants moved for summary judgment on all claims, which the law division granted. (1) unlawful conduct by a defendant; The new jersey consumer fraud act (cfa) was enacted in 1960 to protect new jersey citizens against deceptive business practices.

Based on the consumer fraud act and new jersey case law, both the entity and certain employees and principals should be named as defendants in a case depending on the circumstances. New jersey statutes annotated title 56. When the deposit was not returned, plaintiffs sued, asserting claims under the uniform commercial code (“ucc”)and the consumer fraud act (“cfa”), and alleging breach of contract.

A short google search and perhaps personal experience shows that consumer fraud increases during the holidays. (2) an ascertainable loss sustained by the plaintiff; A new jersey commercial litigation attorney offers examples of cfa’s protection:

New jersey’s udap law, called the new jersey consumer fraud act, is particularly strong. It protects consumers from sales fraud of all types, from fraud in car sales, to fraudulent sales of consumer goods, to deceptive practices by contractors. So we thought that a look at the new jersey consumer fraud act would be helpful.

For defense attorneys and our clients, any pleading which contains a count under the consumer fraud act (n.j.s.a. The nj consumer fraud act does not allow parties to bring actions for either emotional distress, inconvenience, or other “noneconomic” damages. If a seller’s disclosure is completed this is a defense to a selling realtor.

Under the act, a consumer could be entitled to attorney fees if the consumer prevailed in a lawsuit against a contractor if the consumer could prove: The new jersey consumer fraud act is designed to protect consumers in a variety of transactions for both tangible items and services. As one of the first consumer protection laws in the country, it was heralded as a great success and served as the.

This act, enacted in 1960 and amended in 1975, affords protection to consumers suffering any proven loss of any money or real or personal property. However, realtors have numerous defenses under the new jersey consumer fraud act with regard to the tripling of damages which many businesses were entities do not have. The new jersey consumer fraud act extends some of strongest protections against consumer fraud act in the nation.

New Jersey Consumer Fraud Act Forms Lexisnexis Store

It Is The New Jersey Consumer Fraud Act Not The New Jersey Breach Of Contract Act Consumer Financial Services Law Monitor

2

Sample Balloon Mortgage Supplement P 34 - Ppt Download

New Jersey Consumer Fraud Act Forms Lexisnexis Store

2

Defense Of Real Estate Consumer Fraud Act Claims

The New Jersey Consumer Fraud Act Three Essential Questions

Bread And Butter Consumer Law Issues Monday July 22 Ppt Download

2

2

What Contractors Have To Fear From New Jerseys Consumer Fraud Act Kates Nussman Ellis Farhi Earle Llp

New Jersey Employment Law

Defense Of Consumer Fraud Act Claims Byrnes Ohern Heugle

![]()

Defending Your Nj Business Against Consumer Fraud Charges Steinberg Law Llc

New Jersey Consumer Fraud Act Forms Lexisnexis Store

Bread And Butter Consumer Law Issues Monday July 22 Ppt Download

New Jersey Employment Law

2